insurance policies are fake india ,Fake insurance policies are on the rise in India; here's ,insurance policies are fake india, Learn about the top 5 scams in insurance in India, including digital fraud, fake policies, and phishing. Discover tips to protect yourself and avoid becoming a victim. $7,050.00

In recent years, the insurance industry in India has been plagued by a rise in fraudulent activities and scams. From digital fraud to fake policies and phishing schemes, unsuspecting individuals have fallen victim to these deceptive practices. It is crucial for policyholders to be aware of the top scams in the insurance sector and take necessary precautions to avoid becoming a victim. In this article, we will delve into the world of fake insurance policies in India, explore the various types of insurance scams, and provide valuable tips on how to protect yourself from falling prey to fraudsters.

Fake insurance policies are on the rise in India; here's why

The proliferation of fake insurance policies in India can be attributed to various factors, including the increasing digitization of the insurance industry, lack of awareness among policyholders, and the presence of unscrupulous agents and brokers. Fraudsters have been able to exploit loopholes in the system and prey on unsuspecting individuals by offering them bogus insurance policies that promise lucrative returns or coverage at unrealistically low premiums. In some cases, policyholders may not even realize that they have been sold a fake policy until they try to make a claim and discover that the policy does not exist.

Policyholder Beware – Top 5 Insurance Scams in India

1. Digital Fraud: With the rapid advancement of technology, fraudsters have found new ways to deceive policyholders through digital means. This includes phishing emails, fake websites, and fraudulent mobile apps that mimic legitimate insurance companies. Policyholders should always verify the authenticity of any communication or platform before sharing personal information or making payments.

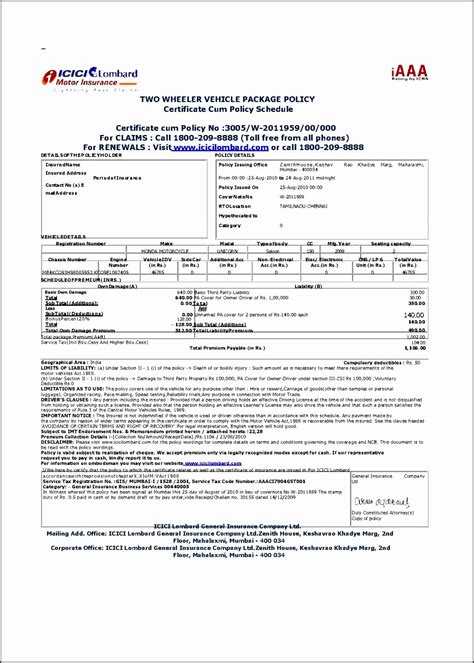

2. Fake Policies: One of the most common scams in the insurance industry is the sale of fake policies by unauthorized agents or brokers. These policies may appear legitimate on the surface, but upon closer inspection, policyholders may discover that the coverage is non-existent or the policy has been fabricated. It is essential to always purchase insurance policies from authorized and reputable insurers to avoid falling victim to this scam.

3. Phishing: Phishing scams involve fraudsters posing as legitimate insurance companies or agents to trick policyholders into disclosing sensitive information such as bank account details or personal identification. Policyholders should be cautious of unsolicited emails or phone calls requesting such information and should always verify the identity of the sender before responding.

4. Mis-selling: Another common scam in the insurance industry is mis-selling, where agents or brokers manipulate policyholders into purchasing policies that are not suitable for their needs or financial situation. Policyholders should carefully review the terms and conditions of any policy before making a purchase and seek advice from a trusted financial advisor if needed.

5. Identity Theft: Fraudsters may use stolen identities to purchase insurance policies in the name of unsuspecting individuals and then make fraudulent claims on those policies. Policyholders should regularly monitor their credit reports and insurance statements for any suspicious activity and report any unauthorized transactions to their insurance company immediately.

Insurance Fraud and its Types: How to Avoid It?

Insurance fraud can take many forms, including policyholder fraud, provider fraud, and internal fraud committed by employees of insurance companies. To avoid falling victim to insurance fraud, policyholders should follow these tips:

1. Verify the authenticity of insurance companies and agents before purchasing a policy.

2. Read the terms and conditions of the policy carefully to ensure that it meets your needs.

3. Be cautious of unsolicited communication or offers that seem too good to be true.

4. Keep your personal information secure and do not share it with unknown individuals or companies.

5. Report any suspicious activity or fraudulent behavior to the relevant authorities or insurance company.

What Is Insurance Fraud and Its Types in India

Insurance fraud is a serious crime that can have far-reaching consequences for both policyholders and insurance companies. In India, insurance fraud can take various forms, including:

1. Staged Accidents: Fraudsters may stage accidents or deliberately cause damage to their property to make fraudulent insurance claims.

2. False Claims: Policyholders may submit false information or documents to support their insurance claims, such as fake invoices or receipts.

3. Premium Fraud: Agents or brokers may misrepresent the terms of the policy or collect premiums without issuing a valid policy to the policyholder.

4. Ghost Policies: Fraudsters may create fake policies in the names of unsuspecting individuals and then make fraudulent claims on those policies.

Battle against Insurance Fraud: Types, Prevention

Insurance companies in India are taking proactive measures to combat insurance fraud and protect policyholders from falling victim to scams. Some of the initiatives undertaken by insurance companies include:

1. Implementing robust anti-fraud measures, such as data analytics and fraud detection software, to identify suspicious claims.

insurance policies are fake india $10K+

insurance policies are fake india - Fake insurance policies are on the rise in India; here's